The recovery of the Pesse canoe from about 10,000 years ago marks the earliest instance known to us when a boat was made1, demonstrating how humans have created tools to overcome geographical barriers to connect to other places. Modes of connectivity have since progressed tremendously and remain a critical role in economic growth.

Impact of Connectivity on Trade

Member states of the Association of Southeast Asian Nations (ASEAN) developed the Master Plan on ASEAN Connectivity (MPAC) in 2010 with the aim of realising continued economic growth in the region.2

Under MPAC, various initiatives were lined up to improve connectivity in ASEAN via roads and highways, railways, airport, industrial estates, power and digital hubs, as well as enhance institutional and people-to-people linkages.

Connectivity has had a significant impact on trade. Six years after the MPAC was first developed, the World Bank Group published the Enhancing ASEAN Connectivity Monitoring and Evaluation report. It found that under MPAC, if the number of days required to export decreased by just one, intra-ASEAN export volumes would be expected to increase by nearly 8%. Previously, this was only 3%.3,4 In the same report, the World Bank Group also reaffirmed that the improvements in connectivity assets, coupled with increased trade and improved border controls, have led to greater trade integration.

Huge Market in Connectivity projects

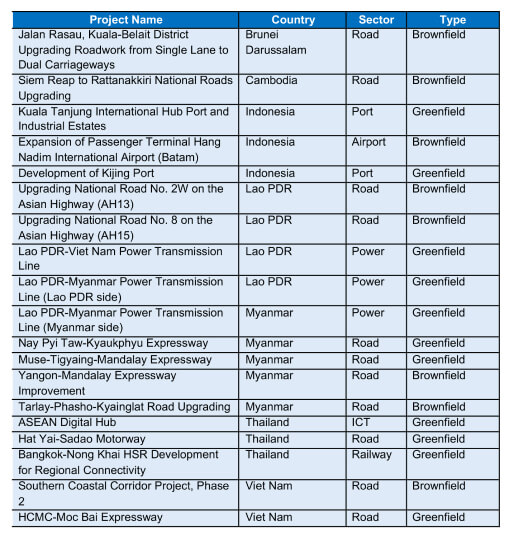

To attract more public and private investments for infrastructure, ASEAN introduced the MPAC 2025, with a rolling priority pipeline list of potential ASEAN infrastructure projects and sources of funds5. The initial pipeline consists of 19 identified projects that are expected to attract investments.

Countries outside of ASEAN have also embarked on various projects to enhance intercountry and interregional connectivity, both to meet growing demand and to boost their economy. The European Unions (EU) EU Strategy, for example, includes an ambitious plan to connect the EU to Asia. Its projects include the worlds first block-to-block aviation agreement, the EU-ASEAN Comprehensive Air Transport Agreement (CATA), the construction of 4,800 kilometres of road and rail, six ports and 11 logistics centres across European and Asian countries (such as Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine) by 2030. The EU-ASEAN CATA alone is expected to bring up to US$8.7 billion worth of economic benefits in the first 7 years from 2017-2023.6

Connectivity Projects in Asia

Governments, multi-development banks and private investors all play a role in cross-border connectivity projects. Brookfield Asset Management, which has an office in Singapore, is one of the largest infrastructure investors in the world, with approximately US$112 billion assets in the sector, approximately US$13 billion of which is in Asia Pacific. It currently owns and operates port, rail and road assets, moving freight, bulk commodities and passengers across five continents. This includes over 10,300 km rail operations, 4,200 km of toll roads and 37 ports.7

Brookfield Managing Partner and Asia Pacific CEO Stewart Upson says: Brookfield has been active in Asia since 2007 and the region continues to be a critical market. We are proud to be part of the regions ongoing development through our operations in infrastructure and other asset classes. As investor interest in Asian infrastructure continues to grow, we will continue to expand our footprint throughout the region.

South American Toll Roads, photo courtesy of Brookfield Asset Management Inc.

The Asian Development Bank (ADB) has also pledged substantial support for constructing regional road infrastructure and announced a large pipeline of planned lending operations. In 2001, the ADB established the Central Asia Regional Economic Cooperation (CAREC) Programme with 11 participating countries8?to facilitate regional infrastructure projects. It has since financed 200 such projects in transport, energy and trade worth US$37 billion.

Facilitating infrastructure projects

When one thinks about an infrastructure project, physical structures come to mind. And naturally so, for these facilitate the movement of people, goods and services. However, processes and studies involved in the preparation stage are equally important. Planning studies, transactions agreements, border management standard operating procedures (SOPs) and land border crossing agreements ensure that connectivity projects can be executed in accordance with best practices and procedures.

Denmark-headquartered technical consultant Ramboll, which has an office in Singapore, conducted a feasibility study in 2014 for the Philippines combined new Sangley Airport and Seaport project. The project was envisaged as the new gateway to Manila and the Philippines.9Rambolls report, Gateway Asia 2030: Feasibility study for new major airport and seaport project, studied and provided the stakeholder analyses, market forecasts geotechnical assessments, coastal hydraulic assessments, Initial Environmental Evaluation (IEE), port planning, airport planning, infrastructure and urban planning, financial assessments and draft business plans. These ensured that the processes in the project were carried out properly. (Note: The Sangley Airport was recently opened, in November 2019.)

Aerial view of airport in Manila

Singapores value-add to connectivity projects

Singapore, one of the most prominent trading hubs in the world, has seaports connected to 600 ports in over 120 countries, and is a global leader in logistics and supply chain management. Together, transport and storages value-add was approximately US$22billion (2017), at 7% of GDP. According to Singapores Department of Statistics, the nation housed a total of 12,555 establishments in the transport and storage sector10. Many multinational companies (such as DHL, TNT, FedEx, Kuehne + Nagel, Sankyu and UPS) have centralised their regional supply chain operations here.11The effect of Singapores strong trade and logistics ecosystem on the economy is obvious. In 2018, Singapores trade to GDP ratio was 326%. In comparison, the world average was 59.4%, while that of OECD members was 58.3%.12

Singapores ecosystem continues to come up with new offerings for regional players looking to develop various stages of their connectivity projects. There exists a wide range of solution providers across the infrastructure value chain, including developers, financiers, professional services and other supporting services.

In the logistics and supply chain sector, Singapore-grown PSA International and GeTS (Global eTrade Services) developed the CALISTA platform to improve facilitation of cross-border logistics flow, regulatory flow and financial flow. The system allows digital booking, documentation, trade declarations and financial transactions trade and trace, amongst others. It also utilises blockchain and artificial intelligence to exchange data between multiparty players, including private businesses and government entities. To date, CALISTA has connected to 61 custom nodes globally across Asia, Middle East, Africa, Europe, North America and South America.

Photo courtesy of Global eTrade

Companies such as YCH Group also continue to augment the ecosystems offerings by providing industry best solutions and talent development. The supply chain solutions company, based in Supply Chain City in Singapore, founded the Supply Chain and Logistics Academy (SCALA) to support the development of talents in this field. It also invests and cultivates supply chain start-ups to develop newer solutions that are at the frontier of the industry. YCHs expertise extends to the rest of the region as well. In July 2019, YCH Group signed a Memorandum of Understanding (MoU) with Yanglin Economic and Technological Development Zone Party in China to collaborate on developing a YCH Kunming Modern Logistics Park Project in Yunnan province.13The project seeks to intensify the growth of logistics infrastructure and capabilities in the region. YCH will also develop supply chain financing, logistics training and education within the Park.

On the financial front, Singapores ecosystem can support logistics financing and investment and reduce costs for the flow of goods, which is critical to support economic growth along the trade corridors. There is a great deal of interest from equity investors in this sector, and Singapore has been an early active player in this field. For instance, Asias first listed infrastructure fund was launched on the Singapore stock exchange in 2005.14The logistics value chain involves modern warehouses, provides a steady revenue stream and sees potential for greater expansion. In light of the e-commerce wave and a growing middle income in ASEAN countries, it is possible for such infrastructure investments to take on public equity listing.

The use of blockchain or e-financing can also add on to the supply chain financing solutions. Singapore-headquartered DBS Bank is a recent example. Since 2019, it has started a blockchain trading platform in Singapore, the ICC TradeFlow, to connect trade partners and streamline the tradition paper-based trade processes.15The platform reduces processing time by more than 50%, improves the flow of information, and unlocks capital to finance more infrastructure development.

Role of Infrastructure Asia

The Singapore ecosystem presents many possibilities to international players. Infrastructure Asia, through strategic partnerships with best-in-class infrastructure players, has access to the latest insights and solutions from the best in the industry.

Infrastructure Asia is Singapores representative on the Lead Implementing Body for the MPAC 2025 Strategic Area of Sustainable Infrastructure (LIB-SI). This body was formed by ASEAN members to realise the rolling priority pipeline list of potential infrastructure projects. Over the next few months, Infrastructure Asia will organise a series of in-depth discussions with the project owners, interested solution providers as well as equity and debt providers to explore how we can help advance opportunities to the next phase, and for some, towards financial closure.

Annex - List of Initial Pipeline of Potential ASEAN Infrastructure Projects

1The Drents Museum. The Pesse Canoe. Retrieved from?https://drentsmuseum.nl/en/in-the-spotlight-top-exhibits/pesse-canoe

2The ASEAN Secretariat. (December 2010). Masterplan on ASEAN Connectivity, Executive Summary (i). Retrieved from?https://www.asean.org/storage/images/ASEAN_RTK_2014/4_Master_Plan_on_ASEAN_Connectivity.pdf

3The World Bank. (17 May 2019). As ASEAN Continues to Integrate, New Report Addresses Progress and Gaps in Connectivity. Retrieved from?https://www.worldbank.org/en/news/feature/2017/05/09/as-asean-continues-to-integrate-new-report-addresses-progress-and-gaps-in-connectivity

4International Bank for Reconstruction and Development, The World Bank. (24 May 2016). Enhancing ASEAN Connectivity Monitoring and Evaluation. Retrieved from?http://documents.worldbank.org/curated/en/119821468023689664/pdf/16-05-24-MPAC-M-E-Full.pdf

5ASEAN Secretariat News. (10 June 2019). ASEAN identifies potential infrastructure projects. Retrieved from?https://asean.org/asean-identifies-potential-infrastructure-projects/

6European Union External Action. (September 2019). Factsheet on Connecting Europe & Asia. Retrieved from?https://eeas.europa.eu/sites/eeas/files/eu-asian_connectivity_factsheet_september_2019.pdf_final.pdf

7Brookfield Asset Management Inc. Infrastructure. Retrieved from?https://www.brookfield.com/our-businesses/infrastructure

8The 11 countries are: Afghanistan, Azerbaijan, the PRC, Georgia, Kazakhstan, the Kyrgyz Republic, Mongolia, Pakistan, Tajikistan, Turkmenistan, and Uzbekistan

9Ramboll. Gateway Asia 2030: Feasibility study for new major airport and seaport project, Manila. Retrieved from?https://ramboll.com/projects/group/feasibility-study-for-airport-and-seaport-manila

10Singapore Department of Statistics. Singapores Transport and Storage Services Industry 2017. Retrieved from?https://www.singstat.gov.sg/~/media/Files/visualising_data/infographics/industry/transport-and-storage-services-2017.pdf

11Singapore Tourism Board. Aerospace and logistics. Retrieved from?https://www.visitsingapore.com/mice/en/key-industries/aerospace-logistics/overview/

12World Bank, DataBank. World Development Indicators. Retrieved from?https://databank.worldbank.org/reports.aspx?source=2&series=NE.TRD.GNFS.ZS&country=

13YCH Group, 16 July 2019. YCH Group Poised to Develop Modern Logistics Park Project in Kunming, China. Retrieved from?https://www.ych.com/press-release/2019-07-16/

14Global Capital. Singapores new taste for infrastructure funds, 22 May 2007. Retrieved from?https://www.globalcapital.com/article/yvy11rkr25qq/singapores-new-taste-for-infrastructure-funds

15Fintech Futures. DBS Bank unveils trade finance blockchain project, 8 Nov 2019. Retrieved from?https://www.fintechfutures.com/2019/11/dbs-bank-unveils-trade-finance-blockchain-project/

This article was collated by Seth Tan and Victoria Song, and benefitted from the information and views shared by:

- Stewart Upson, Brookfield Managing Partner and Asia Pacific CEO

Source: Infrastructure Asia